You’ve heard it 1,000,000 occasions, however I’ll say it once more. It pays to buy round to your mortgage.

Freddie Mac advised us some time again, and now the Client Monetary Safety Bureau (CFPB) has echoed the identical.

And it’s not a trivial quantity of financial savings. The bureau discovered that worth dispersion for mortgages is usually 50 foundation factors (.50%) of the APR.

When a median mortgage quantity of about $300,000, we’re speaking a distinction of roughly $100 monthly.

That’s $1,200 yearly in further prices (or financial savings) and $6,000 via the primary 5 years of the mortgage time period.

Mortgage Lenders Provide the Identical Actual Merchandise at Completely different Costs

Much like nearly every other enterprise, mortgage lenders supply the identical merchandise for various costs.

House loans apart, plenty of firms promote the very same product. That’s why there are comparability web sites or Google procuring.

You enter a product and also you’re offered with varied costs, delivery prices, and so forth.

Throw in a coupon code or pricing particular and one firm could possibly be providing fairly the cut price relative to the remainder.

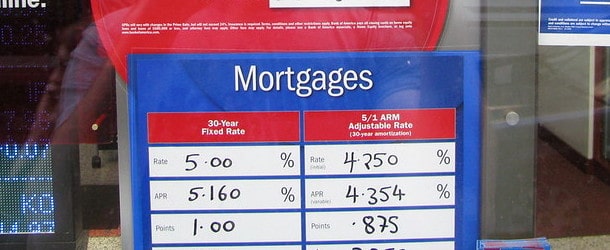

Whereas mortgages are slightly extra distinctive, as you’re working with a crew of people to shut your mortgage, the underlying product is mostly the identical, a 30-year fastened mortgage.

Most house consumers and even current householders who refinance select a 30-year fixed-rate mortgage.

This implies you’re getting the identical product no matter the place you get it from. The distinction is the service and maybe the competency of the corporate or particular person to truly fund the factor!

However assuming we’re evaluating two competent lenders (or mortgage brokers), you wind up with precisely the identical factor.

As such, you shouldn’t pay extra for it. And to keep away from paying extra for it, you must put within the time to buy mortgage charges AND charges.

Pricing Can Fluctuate Significantly Throughout All Mortgage Varieties

The CFPB performed an evaluation to find out the magnitude of worth dispersion amongst house loans.

They did this by combing via House Mortgage Disclosure Act (HMDA) information from 2021.

They usually discovered that costs assorted “in nearly each phase of the mortgage market.”

This consists of conforming loans backed by Fannie Mae and Freddie Mac, jumbo loans, and government-backed choices, reminiscent of FHA loans and VA loans.

As famous, this worth dispersion for mortgages usually hovers round 50 foundation factors (0.50%) of the annual proportion fee (APR).

For instance, throughout 2021 the median rate of interest was 3% (sure, all of us miss these days!).

However not everybody bought a 3% mortgage fee. Many owners bought saddled with a fee of three.5% or increased.

We’re speaking a month-to-month fee of $1,265 for a 3% rate of interest versus $1,347, which is a distinction of $82 a month.

Immediately, we is likely to be speaking a few 6.5% fee vs. a 7% fee, respectively, or roughly $1,896 vs. $1,996.

Not solely are you overpaying much more at present, however doing so would possibly make the mortgage unaffordable given how excessive charges and residential costs are.

Why Do Mortgage Charges Fluctuate by Lender?

Now as to why there’s worth dispersion within the first place, the CFPB factors out a number of completely different causes.

For one, not all lenders are created equal. Some have retail branches, whereas others solely exist on-line. We’re speaking a web site vs. brick-and-mortar workplace area.

By way of enterprise practices, some retain their loans on their books and/or the mortgage servicing, whereas others rapidly promote them off and transfer on to the following mortgage.

There’s additionally branding – those you’ve heard of would possibly spend some huge cash on promoting and cost barely increased charges because of this.

Others could hold their rates of interest elevated to ration demand, aka restrict purposes on account of capability. Or just calibrate to their urge for food.

It’s additionally potential that firms that don’t impose lender overlays cost extra for the elevated threat.

Lastly, it’s merely a matter of debtors not procuring round. The standard borrower solely speaks to at least one lender and believes costs are the identical regardless.

So charges aren’t essentially dictated by conventional provide and demand variables.

My assumption is it’s tougher to check costs on a mortgage than it’s a toaster.

Because of this, many customers simply go along with the primary lender they converse with and name it a day.

If You Don’t Store Your Mortgage, You May Overpay for the Subsequent 30 Years

Now right here’s the kicker on the subject of a house mortgage. Should you do wind up with a mortgage fee .50% increased than the competitors, it’ll hit your pockets month after month.

It’s not a one-time misstep like a TV buy or a lodge room. You don’t simply pay further one time and neglect about it.

That increased fee sticks with you for so long as you maintain your mortgage. If we’re speaking a few 30-year fastened house mortgage, that could possibly be some time.

So the error of not procuring your fee may cost a little you $100 every month for so long as the mortgage is held.

For me, that’s rather a lot worse than overpaying for a product one time.

Lengthy story quick, should you’re severe about saving cash, you’ve bought to place in a while and converse to greater than only one lender.

A correct house mortgage search ought to embody native banks, credit score unions, mortgage brokers, and on-line lenders. Don’t restrict your self to only one sort of firm.