A brand new survey from John Burns Analysis & Consulting discovered that 5.5% is the “magic mortgage charge.”

By magic, they imply the edge for a house purchaser earlier than they balk at a purchase order.

Checked out one other approach, if mortgage charges had been 5.5% or decrease, most potential dwelling patrons would proceed with the transaction.

Ultimately look, the typical charge on a 30-year fastened was 6.27%, in response to Freddie Mac.

This implies we’re fairly near mortgage charges now not being a roadblock for brand new dwelling patrons.

5.5% Mortgage Charges Are Inside Attain

As famous, the 30-year fastened is averaging round 6.25% at current. Whereas this would possibly sound excessive, charges have fallen for 5 consecutive weeks, per Freddie Mac.

You may thank the short-lived banking disaster and a few favorable financial studies (with regard to inflation) for that.

Nonetheless, they’re a far cry from the 2-3% charges on supply again in 2020 and 2021. However as a result of it’s been some time now, charges are solely up about 1% from a yr in the past.

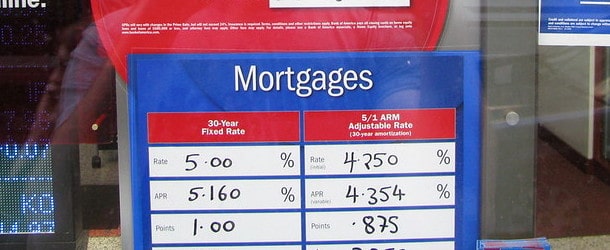

The 30-year fastened averaged 5.00% at the moment in 2022, not an enormous soar. And charges exceeded 7% again in October.

In order it stands, mortgage charges aren’t horrible. And older generations will argue that they’re traditionally low. Or level you to mortgage charges within the Nineteen Eighties.

No matter all that, it seems immediately’s dwelling purchaser is OK with a 5.5% mortgage charge. However something past that is perhaps a deal breaker.

71% Gained’t Purchase a Dwelling If the Mortgage Fee Is Above 5.5%.

Now to that survey. The New Dwelling Developments Institute group at John Burns Analysis & Consulting surveyed greater than 1,300 householders and renters in late February and early March.

They discovered {that a} whopping 71% of potential dwelling patrons who plan to make the most of a mortgage “say they don’t seem to be prepared to just accept a mortgage charge above 5.5%.”

In different phrases, 5.5% is the restrict. Something past that they usually gained’t budge.

This is perhaps as a result of 62% of those similar shoppers indicated that “a traditionally regular mortgage charge is under 5.5%.”

They’d be proper if you happen to solely think about mortgage charges since 2010, as seen within the chart above retrieved from FRED. Previous to that, charges between 6-8% had been the norm.

Some 55% of those respondents additionally consider it’s a unhealthy time to purchase a house, whereas solely 22% assume it’s a superb time to purchase.

So if the mortgage charge piece of the equation isn’t favorable, they’re in all probability not going to proceed.

This speaks to dwelling costs being fairly elevated, regardless of some pullbacks over the previous yr or so.

And the continued lack of high quality present stock, which is proving to be a boon for dwelling builders.

Dwelling Builders Are Shopping for Down Mortgage Charges Beneath 5% to Make Offers Works

The excellent news is most of the largest dwelling builders are shopping for down mortgage charges to make offers pencil.

They usually’re going past 5.5%, usually pushing charges under 5% for his or her prospects.

They’re capable of pull this off for quite a lot of causes. There’s that lack of competitors from the resale market (as a result of mortgage charge lock-in impact).

Merely put, most present householders aren’t promoting as a result of they wish to retain their 2-3% rate of interest.

This has allowed new dwelling builders to boost their costs, or a minimum of not decrease them.

Moreover, development prices have fallen, and lumber costs are approach down.

Consequently, builders are “paying as a lot as 6.0% of the mortgage quantity” to purchase down the mortgage charge.

For the document, present householders can accomplish this too by way of vendor concessions that can be utilized for low cost factors.

This enables dwelling patrons to qualify at a decrease rate of interest and scale back their month-to-month housing cost. It might additionally make offers look extra favorable.

And mortgage lenders may also supply non permanent buydowns that scale back mortgage charges for the primary 1-2 years.

However none of this adjustments the truth that dwelling costs stay lofty.