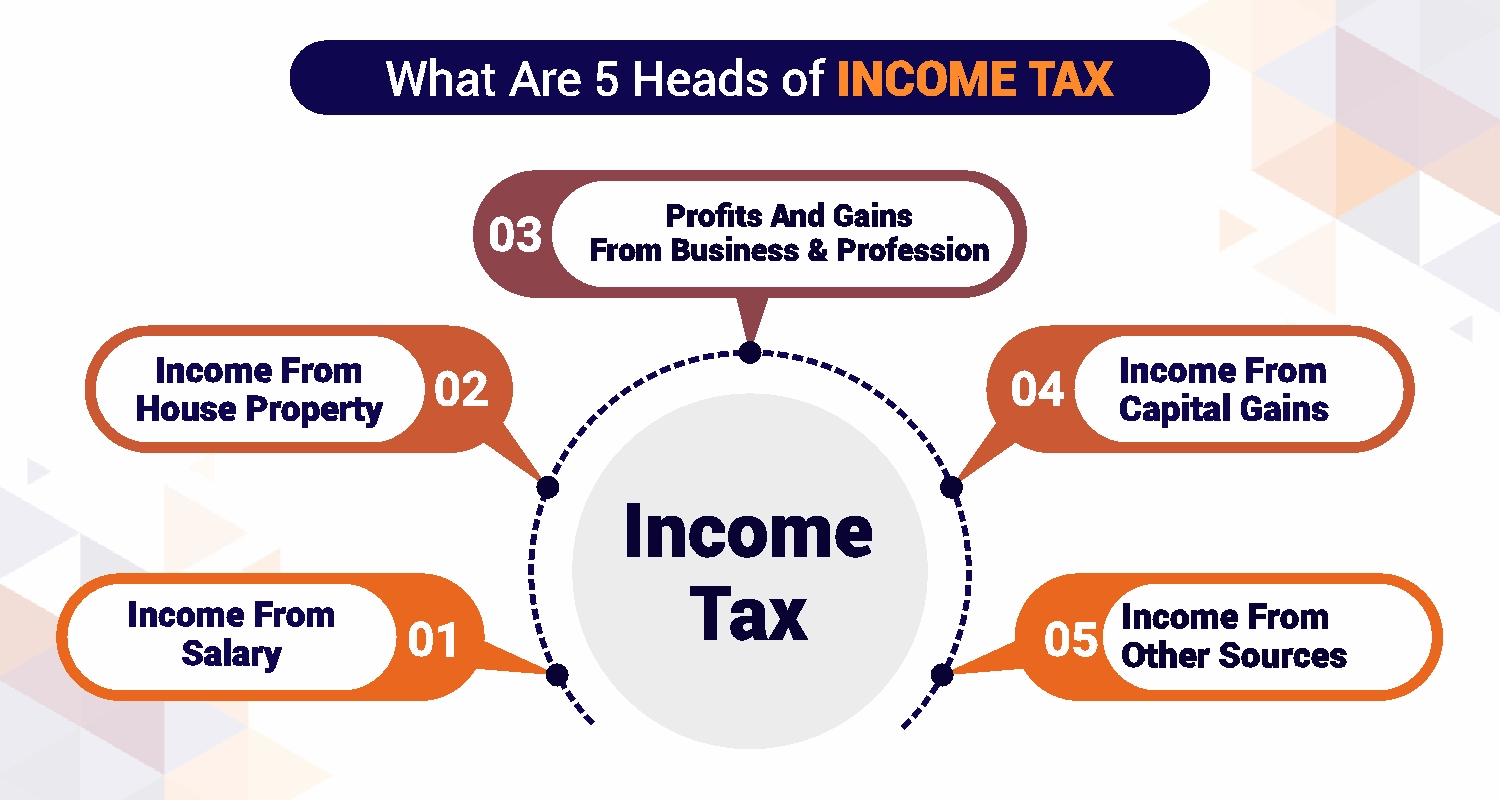

Individuals and companies earn earnings from a number of sources like curiosity, wage, income, session, lease, and dividend earnings. When paying your taxes, it will get troublesome for each the payer and the collector (Authorities) to take care of uniformity within the bifurcation and deal with every earnings proper. Because of this the Revenue Tax Act has specified correct bifurcations for each kind of earnings into 5 completely different heads of earnings. What are the 5 heads of earnings tax? Let’s perceive.

1. Revenue From Wage:

Wage is the remuneration an employer pays to an worker below a contract of employment. Sections 15 to Part 17 of the Revenue Tax Act cowl tax therapy of wage earnings. Wage consists of financial and non-monetary advantages that embrace elements like primary wage, bonus, gratuity, pension, and depart encashment. The tax therapy for the first elements of wage are as follows:

Home Hire Allowance (HRA) helps you pay lease should you stay in a rented home. It’s partly taxable, and the exemption is predicated on the least of those:

- 50% of primary wage in metros (40% in non-metros)

- Precise HRA obtained

- Hire paid minus 10% of primary wage

- Depart Journey Allowance (LTA) is for trip journey in India. It’s exempt should you present proof, like tickets. The exemption is for journey bills through the shortest, least expensive route and covers members of the family who stay with you.

- Commonplace Deduction of Rs.50,000 applies to all salaried staff, changing earlier transport and medical allowances.

Different allowances, like these for kids’s schooling or journey, have diversified tax remedies. Some are absolutely taxable, whereas others are exempt inside limits. Part 10 of the Revenue Tax Act supplies the whole record of allowances and their tax particulars.

Aside from the allowed exemptions, you additionally get deductions below wage earnings. These embrace:

- Skilled tax (deducted by employer)

- TDS (Tax Deducted at Supply)

- EMployee’s PPF contribution

2. Revenue From Home Property:

Sections 22 to 27 of the Revenue Tax Act, 1961 cowl the Revenue from Home Property. This head of earnings tax consists of the tax on earnings earned from home property or land connected to it. In easy phrases, it lays out how rental earnings from properties is taxed. Revenue from Home Property is classed into three classes:

- Self-Occupied Property

- Let-Out Property

- Deemed Let-Out Property

If somebody owns greater than two self-occupied homes, solely two are handled as self-occupied, whereas the remaining are deemed set free. The taxation applies to earnings from each residential and industrial properties.

To compute the earnings from home property, just a few vital ideas to know are-

- Gross Annual Worth (GAV) is the anticipated annual lease of a property. It is dependent upon precise lease, municipal valuation, honest lease, and commonplace lease as per the Hire Management Act.

- Internet Annual Worth (NAV) is the taxable earnings from the property after deducting municipal taxes and emptiness loss. NAV = GAV Municipal taxes Emptiness loss.

- Tax Advantages:

- Part 24 permits a 30% commonplace deduction on NAV and curiosity on house loans (as much as Rs.2 lakh if accomplished inside 5 years).

- Part 80EE gives a Rs.50,000 deduction for loans sanctioned in 2016–2017, with limits on property worth and mortgage quantity.

- Part 80EEA supplies a Rs.1.5 lakh deduction for loans taken between 2019 and 2022 for inexpensive housing.

3. Earnings And Beneficial properties From Enterprise and Occupation:

This head of earnings tax consists of people, partnerships, or firms concerned in commerce, enterprise, or skilled actions. All earnings from such operations fall below this head of earnings. Revenue is calculated by subtracting business-related bills like salaries, lease, depreciation, and utilities from complete income. This is likely one of the most complete earnings classes, protecting almost all earnings from enterprise or skilled actions. Revenue sources, talked about in Part 28, embrace:

- Earnings or positive factors from any enterprise or occupation.

- Funds obtained for termination or modification of contracts or company phrases.

- Sums obtained from a keyman insurance coverage coverage taken for essential staff or companions.

- Earnings from authorities export schemes just like the Responsibility Disadvantage or Responsibility-Free Replenishment Certificates.

- Revenue from promoting capital property held as stock-in-trade, comparable to artwork or historic collections held as stock-in-trade.

- Curiosity, wage, or bonuses earned as a companion in a agency.

- Funds for utilizing mental property, technical data, logos, or franchises.

- Earnings from offering industrial, scientific, or industrial rights or companies.

4. Revenue From Capital Beneficial properties:

Whenever you promote a capital asset and make a revenue, that revenue is taxed as capital positive factors and taxed below this head of earnings tax. Frequent capital property embrace shares, actual property, gold, bonds, and mutual funds. Capital positive factors are of two varieties:

- Brief-term Capital Beneficial properties: Earnings from promoting property held for lower than 12 months (e.g., shares)

- Lengthy-term Capital Beneficial properties: Earnings from property held for over 24 months (e.g., actual property)

Tax charges depend upon the asset and holding interval. For instance, long-term capital positive factors (LTCG) from listed fairness shares are taxed at 12.5%, whereas short-term positive factors are taxed at 20%. Capital positive factors needs to be reported in Schedule CG of your ITR.

There are additionally exemptions for capital positive factors:

- Part 54: Exemption on LTCG from promoting residential property if reinvested in one other property.

- Part 54B: Exemption on capital positive factors from promoting agricultural land, and if reinvested, in new agricultural land.

- Part 54EC: Exemption on LTCG if invested in specified bonds inside six months of switch.

5. Revenue From Different Sources:

The fifth head of earnings is a catch-all class that covers any earnings not taxed below wage, home property, enterprise/occupation, or capital positive factors. This head of earnings tax, below Part 56(2) of the Revenue Tax Act, consists of earnings from numerous sources that don’t fall below the opposite 4 heads. Some examples are:

- Dividends from home or overseas corporations

- Curiosity from financial savings accounts, fastened deposits, bonds, and debentures

- Winnings from lotteries, crossword puzzles, races, playing, and betting

- Presents obtained in money or type from anybody

- Revenue from subletting home property

- Revenue from royalties, patents, or copyrights

- Revenue from undisclosed sources or unexplained investments

- Every other earnings not coated by the opposite heads

Understanding the 5 heads of earnings tax is vital when submitting your taxes. Every head has its personal guidelines for exemptions, deductions, and tax charges, so it’s vital to categorise your earnings accurately. Understanding which head applies to your earnings will help you cut back your tax legal responsibility and keep away from penalties, whether or not it is wage earnings, rental earnings from property, or income from promoting investments. When submitting your taxes, ensure you’re categorizing your earnings below the appropriate head to maintain issues easy.