India’s most prestigious credit score bureau is the Credit score Data Bureau (India) Restricted or CIBIL. The company is answerable for offering banks and monetary establishments with an individual’s monetary information, reminiscent of advances, bank cards, and different investments. The information collected is then used to arrange credit score stories containing a person’s CIBIL rating, which monetary establishments use to find out mortgage eligibility.

What Is A CIBIL Rating?

CIBIL scores are three-digit numbers that vary between 300 and 900. Every particular person’s CIBIL is calculated primarily based on their credit score historical past, which determines their creditworthiness. Calculating the CIBIL rating is predicated on monetary data for the final six months with completely different variables of various weights.

How Are CIBIL Credit score Reviews Generated?

CIBIL considers many elements when producing a credit score report.

1. Reimbursement Historical past

Your compensation historical past is probably the most influential consider producing your CIBIL credit score report. Banks, lenders and NBFCs contemplate debtors with poor credit score histories as dangerous. Each mortgage or credit score you avail is reported to CIBIL by your lender, and CIBIL receives all of your compensation historical past for that credit score.

Common and well timed funds will lead to a wonderful CIBIL credit score report. Failure to repay your debt on time will negatively have an effect on your CIBIL rating, regardless of a bank card or a mortgage.

2. Credit score Utilisation Ratio

Typically, lenders will not lengthen loans to debtors with credit score utilisation ratios greater than 35%. This ratio performs a job in figuring out a mortgage applicant’s means to repay in accordance with earnings.

While you use your bank card or every other type of credit score greater than you earn, your CIBIL credit score report takes word of such exercise. Your credit score rating falls when you will have a excessive debt-to-income ratio.

3. A number of Credit score

While you apply for a mortgage or a bank card, your lender critiques your CIBIL credit score report. The extra loans you will have, the decrease your CIBIL credit score rating. Therefore, it is best to repay your current mortgage earlier than making use of for a brand new one to spice up your CIBIL credit score rating.

4. Mortgage Enquiries

Making repeated inquiries about loans might point out that you’re hungry for credit score, negatively affecting your credit score rating.

5. Credit score Playing cards

Bank card utilization additionally impacts credit score scores. A excessive bank card stability demonstrates poor spending behaviour, making a poor credit score rating for the borrower.

6. Secured v/s Unsecured Loans

The danger of a decrease credit score rating will increase if you happen to take a number of unsecured loans. Likewise, your credit score rating will enhance if you happen to repay secured loans on time.

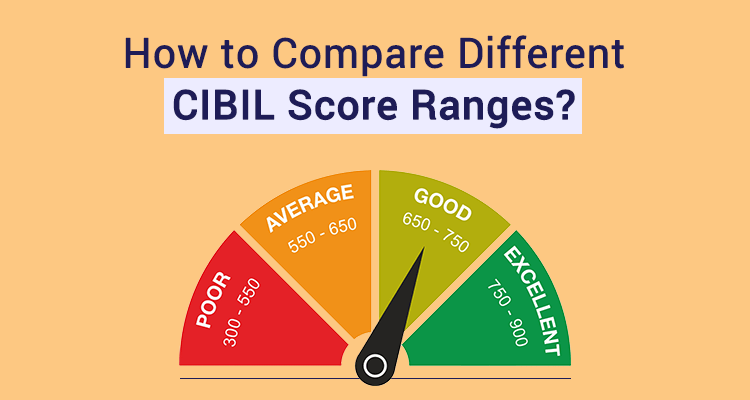

What Is CIBIL Rating Vary?

CIBIL scores vary from 300 to 900, with 900 thought of the very best. Every financial institution requires a unique CIBIL rating for numerous merchandise. Banks and monetary establishments contemplate a CIBIL rating of 650 or greater ideally suited.

Understanding Completely different CIBIL Rating Ranges

The completely different CIBIL ranges are as follows.

• NA/NH

Debtors and not using a credit score historical past can have an NA/NH rating, which stands for “no historical past” or “not relevant”. It signifies no debt or utilizing a bank card. To ascertain a credit score historical past and avail of a mortgage sooner or later, you’ll be able to take a bank card.

• 300-599

CIBIL scores between 300-599 are thought of poor. Debtors who didn’t repay loans and bank cards on time have credit score scores between these ranges. It means you will have unpaid bank card payments or EMIs.

Getting a mortgage or a bank card can be difficult in case your CIBIL rating falls on this vary, as you’re at excessive threat of defaulting.

• 550-649

Your possibilities of getting authorized for a mortgage are slim in case your credit score rating is between 550-649. A credit score rating on this vary is taken into account honest, however most lenders received’t give credit score to individuals with this rating vary. This vary may additionally carry comparatively greater rates of interest from monetary establishments. The debtors might have a CIBIL rating on this vary in the event that they fail to pay their bank card payments and mortgage repayments on time.

• 650-749

This vary of credit score scores is taken into account good. Such a constructive rating signifies good credit score behaviour to monetary establishments, and a mortgage utility could also be authorized rapidly. Regardless of this, some lenders should still cost high-interest charges.

• 750-900

If the debtors pay all their bank card dues and loans on time, their credit score rating ranges from 750 to 900. CIBIL scores on this vary are thought of glorious. An applicant with this credit score rating has a higher likelihood of getting authorized for a mortgage at one of the best rate of interest.

How will your Credit score Rating affect your Mortgage Borrowing Course of?

Your credit score rating performs an important function within the mortgage borrowing course of. It acts as a report card for lenders, reflecting your previous monetary conduct and creditworthiness. This is how your credit score rating vary impacts your mortgage utility:

- Mortgage Approval: A excessive credit score rating (usually above 750) considerably will increase your possibilities of mortgage approval. Lenders view you as a dependable borrower, making them extra comfy providing you a mortgage.

- Curiosity Charges: Your credit score rating instantly influences the rate of interest supplied in your mortgage. credit score rating (usually above 700) qualifies you for decrease rates of interest, saving you cash in the long term.

- Mortgage Phrases: A robust credit score rating (above 650) can result in extra favorable mortgage phrases, reminiscent of longer compensation intervals or decrease down funds.

- Mortgage Quantity: With a excessive credit score rating, you might be eligible for bigger mortgage quantities in comparison with debtors with decrease scores.

Sustaining a superb CIBIL rating is essential for a clean mortgage borrowing expertise. It unlocks entry to raised mortgage choices, saving you cash and providing you with higher monetary flexibility.

CIBIL Rating Ranges: Examine completely different Ranges

The CIBIL rating, starting from 300 to 900, is a key indicator of your creditworthiness. It helps lenders assess your credit score threat (chance of repaying loans). This is a breakdown of the CIBIL rating ranges:

- Above 750: Glorious – This signifies a powerful credit score historical past, making it simpler to safe loans and bank cards at favorable phrases.

- 700-749: Good – Represents a wholesome credit score profile, usually resulting in mortgage approvals with ease.

- 650-699: Honest—When you can nonetheless qualify for loans and bank cards, you would possibly want to enhance to safe higher rates of interest.

- 600-649: Low – This vary signifies the next credit score threat for lenders, probably resulting in stricter mortgage phrases or rejections.

- Beneath 600: Wants Enchancment – This rating would possibly lead to mortgage rejections or unfavorable phrases. Take into account taking steps to rebuild your credit score rating.

Enhance your Credit score Rating Regularly

Your CIBIL rating, a creditworthiness indicator starting from 300 to 900, considerably impacts your monetary well-being. This is tips on how to progressively enhance it:

- Pay Payments on Time: That is paramount. Well timed funds on loans, bank cards, and different payments positively have an effect on your CIBIL rating (ideally above 700 for a superb rating).

- Handle Credit score Utilization: Preserve your bank card balances low. Goal for a credit score utilization ratio (excellent stability divided by credit score restrict) under 30%. This demonstrates accountable credit score administration.

- Assessment Credit score Report Usually: Acquire your free CIBIL report back to establish any errors. Dispute errors promptly to make sure a good credit score rating reflection.

- Construct Credit score Historical past: You probably have restricted credit score historical past, contemplate a secured bank card. Use it responsibly and pay payments on time to determine a constructive observe report.

- Preserve a Credit score Combine: Having a wholesome mixture of credit score varieties, like a secured mortgage and a bank card, can positively affect your CIBIL rating graph. Nevertheless, handle them responsibly to keep away from overextending your self.

Fulfil All Your Monetary Wants With a Mortgage From IIFL Finance

Do not let a low credit score rating maintain you again. IIFL Finance presents quite a lot of loans to satisfy your wants, from private loans to enterprise loans. We perceive monetary wants come up, and a wholesome credit score rating is not at all times the one issue. Get began with a simplified utility course of and focus in your objectives. Go to us in the present day and watch your monetary image enhance! Remember, enhancing your CIBIL rating graph can unlock even higher charges sooner or later!

Often Requested Questions

Q1. What CIBIL rating do monetary establishments contemplate a superb one?

Ans. A CIBIL rating over 750 is right and acceptable for numerous lending establishments.

Q2. How will you right any errors in your CIBIL report?

Ans. If you happen to discover any errors in your credit score report, contact CIBIL at information@cibil.com. The bureau will overview your request and proper any errors.

Q3. What is an effective credit score rating vary?

credit score rating vary usually falls between 670 and 739. This means a wholesome credit score historical past and makes it simpler to get mortgage approvals and probably safe favorable rates of interest. Scores above 740 are thought of excellent, and something above 800 is great, providing the borrower probably the most advantageous mortgage phrases.

This autumn. What are the 5 ranges of credit score scores?

Credit score scores are usually divided into 5 ranges, reflecting your creditworthiness:

- Distinctive (800-850): This prime tier signifies a borrower with an almost flawless credit score historical past. You may take pleasure in simple mortgage approvals and one of the best rates of interest.

- Very Good (740-799): This vary signifies a powerful credit score profile. You may probably qualify for favorable mortgage phrases and aggressive rates of interest.

- Good (670-739): It is a wholesome credit score rating vary, permitting for straightforward mortgage approvals and probably good rates of interest.

- Honest (580-669): When you can nonetheless qualify for loans and bank cards, this rating would possibly result in greater rates of interest or stricter phrases.

- Poor (Beneath 580): This vary suggests a excessive credit score threat. Mortgage approvals could also be troublesome, and if authorized, you will probably face unfavorable rates of interest and phrases.

Q5. What is an effective credit score rating for my age?

Whereas there’s a mean credit score rating for various age teams, it is not one of the best measure. Typically, a superb credit score rating is taken into account above 670. Nevertheless, concentrate on constructing your credit score historical past responsibly. This is why:

- Youthful people may need a shorter credit score historical past, naturally affecting the rating.

- Constant on-time funds and accountable credit score administration are key to constructing a superb rating over time.

Constructing a powerful basis now will profit you vastly sooner or later, unlocking higher mortgage choices and rates of interest.

Q6. Can anybody have 900 CIBIL rating?

Reaching an ideal 900 CIBIL rating may be very uncommon. It signifies a wonderful credit score historical past, with elements like:

- At all times paying payments on time, for years.

- Sustaining a low credit score utilization ratio (owing little in comparison with credit score restrict).

- Having a wholesome mixture of credit score varieties (loans and bank cards) managed responsibly.

Whereas unusual, anybody can try for a near-perfect rating by way of constant accountable credit score administration. Scores above 750 are thought of glorious and provide important advantages. Deal with constructing a powerful rating for a brighter monetary future.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0;t.defer=true; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js');

setTimeout(function() { fbq('init', '2933234310278949'); fbq('init', '3053235174934311'); fbq('track', 'PageView'); }, 10000);