Within the digital age, the place digital transactions and on-line banking dominate, the standard cheque would possibly seem to be a relic from the previous. Nevertheless, cheques nonetheless play a big position in monetary transactions, offering a tangible and safe method to switch cash. Let’s delve into the world of cheques, exploring what they’re and the varied sorts that exist.

What’s a Cheque?

At its core, a financial institution cheque is a written order from an account holder, instructing their financial institution to pay a selected sum of cash to a chosen individual or entity. It serves as a authorized doc, guaranteeing the cost and offering a tangible document of the transaction. Cheques have been in use for hundreds of years, evolving to fulfill the altering wants of the monetary panorama.

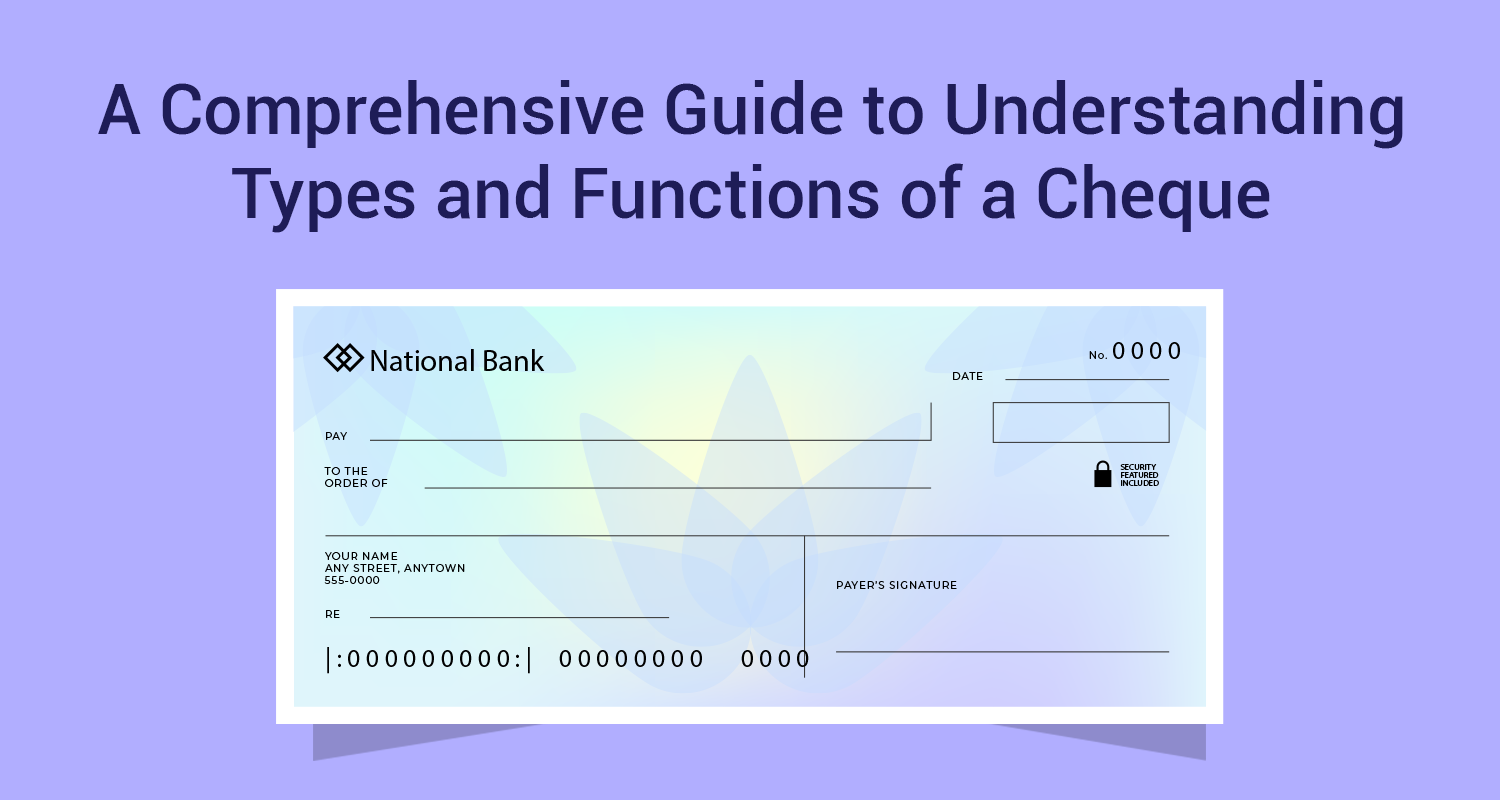

Anatomy of a Cheque:

1. Drawer: The one that writes the cheque, instructing the financial institution to make the cost.

2. Drawee Financial institution: The financial institution the place the drawer holds an account and from which the cash might be withdrawn.

3. Payee: The individual or entity to whom the cheque is addressed, indicating who will obtain the cost.

4. Quantity: The numerical and written representations of the quantity to be paid.

5. Date: The date when the cheque is issued.

6. Signature: The drawer’s signature confirming the authenticity of the cheque.

Sorts of Cheques in a Financial institution:

1. Bearer Cheque:

The which means of a bearer cheque is kind of easy. In a bearer cheque, the cost is made to the one that holds the cheque, i.e., the bearer. These cheques are negotiable devices, and anybody who possesses the cheque can money it. Nevertheless, one of these cheque poses a better danger because it’s much like carrying money. If misplaced or stolen, anybody can use it.

2. Order Cheque:

In case you are questioning about an order cheque which means, it’s a cheque that’s payable to a selected individual or entity talked about on the cheque. It consists of phrases like “Pay to the order of” or “Pay to,” adopted by the payee’s identify. Solely the desired individual or their licensed consultant can encash an order cheque.

3. Crossed Cheque:

Crossing a cheque includes drawing two parallel strains throughout the face of the cheque. This signifies that the cheque can’t be encashed on the counter however should be deposited right into a checking account. Crossing enhances the safety of the transaction by making certain the cash goes straight into the payee’s account.

4. Open Cheque:

An open cheque shouldn’t be crossed, which means it may be encashed on the counter of the drawee financial institution. Whereas handy, it lacks the security measures of a crossed cheque and is akin to carrying money. Subsequently, it is advisable to be cautious when coping with open cheques.

5. Put up-dated Cheque:

A post-dated cheque carries a future date. The drawer points it with the understanding that the payee won’t money it till the desired date arrives. That is typically used as a type of safety or to delay cost till a sure time.

6. Anti-dated Cheque:

In distinction to a post-dated cheque, an anti-dated cheque bears a date sooner than the day it’s issued. Whereas not as widespread, it might be used to satisfy an obligation or settle a debt with an earlier due date.

7. Stale Cheque:

A stale cheque is one that’s not cashed or deposited inside a specified interval, often six months. Banks could refuse to honour stale cheques as a result of danger of inadequate funds or different issues.

8. Traveller’s Cheque:

A Traveller’s Cheque is a fixed-denomination cheque designed for safe journey transactions. That includes pre-printed denominations, it gives the comfort of predetermined values and consists of safety measures like watermarks and twin signatures to reduce the danger of theft. In case of loss or theft, these cheques can typically get replaced, making them a dependable choice for travellers. Their international acceptance makes them a broadly used type of foreign money alternate worldwide.

9. Self-Cheque:

A Self-Cheque is a cheque written by the account holder to themselves, serving the aim of money withdrawal or fund switch. In one of these cheque, the issuer and recipient are the identical particular person. It may be used for withdrawing money on the financial institution counter or transferring funds between the account holder’s personal accounts. Nevertheless, warning is suggested as there’s a safety danger if the self-cheque is misplaced or stolen, probably permitting anybody in possession to misuse it.

10. Banker’s Cheque:

What’s a banker’s cheque, chances are you’ll ask proper? Effectively, a Banker’s Cheque, additionally known as a requirement draft, is issued by a financial institution by itself funds, offering a safe and assured type of cost. Not like conventional cheques tied to a person’s account, a banker’s cheque is drawn on the financial institution’s funds. This ensures safety because the financial institution ensures the desired quantity on the cheque, making it much like a assured type of cost. The banker’s cheque’s validity lasts for 3 months from the issued date. When the interval of validity ends for a cheque, it turns into stale or invalid and can’t be submitted for any cost to the financial institution. Usually used for safe transactions, banker’s cheques are payable to a 3rd occasion, providing reliability and eliminating the danger of bouncing as a consequence of inadequate funds within the drawer’s account.

The Function of Cheques At the moment:

In an period dominated by digital transactions, the position of cheques has developed however stays essential in sure situations. They’re nonetheless used for:

1. Enterprise Transactions:

Many companies, particularly these coping with massive sums of cash or in particular industries, desire the safety and traceability of cheque transactions.

2. Authorized and Monetary Paperwork:

Cheques are sometimes required for authorized and monetary documentation, offering a tangible document of cost.

3. Private Transactions:

Some people nonetheless go for cheques when making or receiving funds, particularly for vital quantities.

4. Rental Funds:

Hire funds are generally made via post-dated cheques, offering a safe and documented methodology for each landlords and tenants.

In conclusion, whereas using cheques has decreased in day-to-day transactions, they continue to be related in varied monetary actions. Understanding the various kinds of cheques empowers people and companies to decide on the most suitable choice for his or her particular wants, balancing comfort with safety within the ever-evolving panorama of economic transactions.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0;t.defer=true; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js');

setTimeout(function() { fbq('init', '2933234310278949'); fbq('init', '3053235174934311'); fbq('track', 'PageView'); }, 10000);