What Is A Cheque?

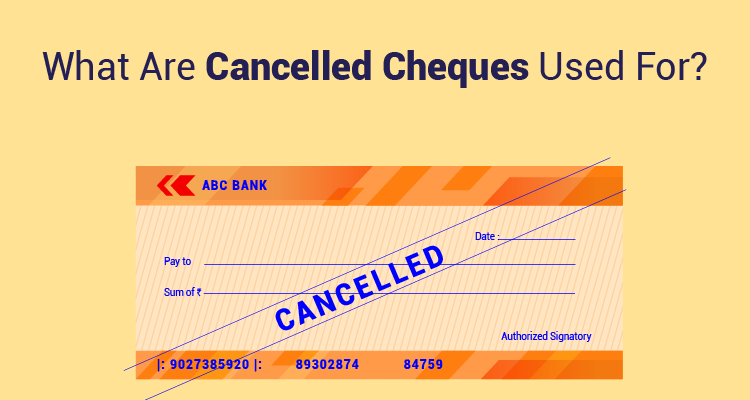

A cancelled cheque is a cheque that has ‘CANCELLED’ written in caps on it between two parallel strains drawn throughout the cheque. It typically serves as validation of the account holder’s data reminiscent of IFSC, MICR, account quantity, financial institution department particulars and the account holder’s identify. This helps forestall withdrawing funds, though there’s a chance that it could fall in improper fingers and be misused.

Tips on how to Cancel a Cheque

Cancelling a cheque could be very easy. Comply with these steps to cancel a cheque:

– Take a leaf out of your cheque e-book.

– Use a blue/black pen and draw two parallel strains throughout the cheque.

– As you draw the strains, guarantee you don’t cancel or overlap IFSC, MICR, account holder’s identify, financial institution identify and department or every other element.

– DO NOT fill in different particulars reminiscent of, identify, quantity or date.

– DO NOT put your signature.

– Write ‘CANCELLED’ in between the parallel strains.

How To Give Cancelled Cheque

When a checking account holder decides to situation a cancelled cheque, he can submit the cheque in both of the next methods:

-By visiting the financial institution department and submitting the bodily cheque to the financial institution.

-By utilizing Telephone Banking service from the financial institution’s app.

-By utilizing the Internet Banking service of the financial institution the place they’ve an account.

What Does A Cancelled Cheque Denote?

A cancelled cheque deters an individual, together with the account holder, from utilizing the cheque to withdraw or pay cash.

A cancelled cheque denotes or validates a buyer’s financial institution particulars, MICR/IFSC codes, identify and department particulars when making a demat account; investing in mutual funds or shopping for an insurance coverage; when making EMI funds; choosing the ECS mode of fee; KYC completion and EPF withdrawal.

It serves as proof that the individual has a checking account.

When is a Cancelled Cheque Required?

A financial institution cancelled cheque is required for the next functions:

- If you wish to open a demat account for investing in shares, mutual funds or when taking insurance coverage.

- If you wish to withdraw cash out of your EPF account.

- When you find yourself choosing the Digital Clearance Service of your financial institution to switch cash out of your account to a different account.

- When choosing an EMI-based fee choice for a high-value buy.

- To finish KYC completion norms.

Distinction Between Cancelled Cheque and Cease Cost

Similar to a cancelled cheque doesn’t enable anybody, together with the issuer of the cancelled cheque to make any transactions, a Cease Cost can also be an instruction from the issuer to not course of a fee.

The fee could be made both in cheque, draft or every other mode of fee. Nonetheless there are some important variations between a Cancelled Cheque and a Cease Cost.

|

Cease Cost |

Cancelled Cheque |

|

The phrase ‘CANCELLED’ is just not talked about on the cheque. |

The phrase ‘CANCELLED’ is talked about on the cheque between two parallel strains drawn throughout the cheque. |

|

A Cease Cost instruction is issued when there are inadequate funds; if the signed cheque is misplaced or if there’s a suspicion of fraud or for every other motive. |

Most frequently, a cancelled cheque is used as proof of 1’s present checking account and their monetary credibility. |

|

A small payment could also be charged for utilizing the Cease Cost choice. |

The financial institution doesn’t cost any payment for issuing a cancelled cheque. |

|

A cheque for which a cease fee instruction has been issued can have all particulars of the issuer together with the signature.

|

A cancelled cheque can have no particulars of the issuer and never even his signature. |

Incessantly Requested Questions

When does one require a cancelled cheque?

A cancelled cheque is required when one desires to open a demat account; desires to withdraw from his EPF; is making a high-value buy; for finishing KYC norms; investing in an insurance coverage coverage/mutual funds and when choosing Digital Clearance Service of your financial institution.

Is it attainable for my financial institution to cancel my cheque?

It’s the accountability of the checking account holder to cancel a cheque. The financial institution won’t do it on his behalf. If the checking account holder doesn’t have a cheque, the financial institution will situation the shopper a chequebook and so they should cancel it and submit it to the financial institution. The financial institution can even not cancel your cheque in your absence.

Can I signal a cancelled cheque?

A cancelled cheque doesn’t require any further particulars as it’s not used for any monetary transaction.

What are the dangers related to cancelled cheques?

Cancelled cheques although can’t be used for withdrawing or sending cash, they nonetheless have very important data such because the account holder’s identify, financial institution identify, IFSC code, and MICR code and therefore there’s a chance of misuse by scammers. Therefore, one needs to be alert all through the aim for which the cancelled cheque is getting used.

Can I cancel the cheque utilizing pink ink?

When writing cheques or filling in monetary data in banks and monetary establishments, all the time use black/blue pen until in any other case specified.

Can I block a cheque leaf on-line?

Sure, you possibly can go for the Internet Banking function of your financial institution to dam a cheque leaf on-line. You too can sign-in by means of the net banking app in your telephone.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0;t.defer=true; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js');

setTimeout(function() { fbq('init', '2933234310278949'); fbq('init', '3053235174934311'); fbq('track', 'PageView'); }, 10000);