Plan your funds successfully with the 50/30/20 rule. Study to handle your funds higher, obtain your monetary targets, and acquire management over your cash with this easy but highly effective budgeting rule!

06:56 IST

2 Views

1 Like

With regular rise in inflation and price of dwelling, it is extremely vital to funds one’s revenue in order to not overspend in pointless bills. Making use of a budgeting rule on one’s month-to-month earnings, assist handle funds and plan for financial savings and investments. 50/30/20 rule is one such budgeting rule. 50/30/20 is a proportion primarily based budgeting rule which was initially popularised by Senator Elizabeth Warren in her e book “All of your value: Final lifetime cash plan”.

What does the 50/30/20 rule imply?

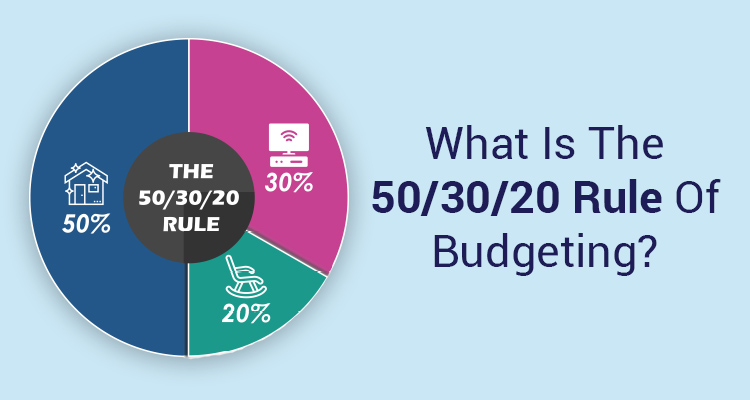

The 50/30/20 rule states that the month-to-month after tax revenue of a person must be divided into three parts. 50% for wants, 30% for desires and 20% for financial savings. With this categorization, will probably be simpler for the person to maintain a monitor on the expenditures and cut back superfluous ones. The aim of this rule is to stability the expenditures and be conscious of financial savings and investments. It additionally helps lower your expenses for medical emergencies and retirement.

50/30/20 Categorizations

Wants: 50%

50% of the after-tax revenue ought to assist cater to wants that are the bills which are important in your survival. Therefore, they can’t be delayed at any price. Wants may embrace bills like home lease, meals and groceries, EMIs, funds of bank card payments and different utility payments, insurance coverage premiums and so forth. If any such fee is delayed or missed then it’d land you in bother or enhance the monetary burden because of late fee charges. Late or delayed fee of bank cards and EMIs additionally hamper your credit score rating.

For those who spend greater than 50% in your wants, then you’ll have to both reduce down in your desires or downsize your way of life. One ought to be capable of determine between want and need. Luxuries like TV cable subscriptions or Netflix, new IPhone and so forth. may be thought of as need. It’s best to chorus your self from such bills till they’ve been deliberate.

Needs: 30%

Needs constitutes a listing of things that aren’t important in your survival however you aspire to amass. That is the trickiest part and wishes most self-discipline. If unregulated, you may find yourself spending your financial savings to fulfil your desires. It’s important to cap the spending in your desires at a degree. You can begin setting apart some quantity as a separate, smaller fund solely devoted to an costly buy. This will even enable you keep away from taking small loans or no-cost EMI traps. To curb your desires, you too can keep away from happening retail remedy and keep away from any pointless purchases.

Financial savings: 20%

Wants and desires cater to current calls for of a person whereas financial savings will assist cater to future calls for. It’ll assist handle submit retirement bills and any unexpected emergency associated to well being or job loss. It’s best to put money into avenues that beat inflation and permit simple withdrawals with out a lot paperwork and withdrawal costs.

You possibly can additionally save and make investments in your long-term targets. You possibly can put money into aggressive development funds like small-cap, multi-cap funds, SIP and so forth. It’s also possible to begin creating an emergency fund which ought to ideally be massive sufficient to cater to your three to 6 months bills plus the quantity used up in your final emergency.

Get Gold Mortgage on the consolation of your own home

Apply Now

Advantages of fifty/30/20 rule

- Easy to understand and apply – It’s a easy framework for budgeting and may be utilized instantly with out advanced calculations.

- Monetary stability – It helps strike a monetary stability amongst your bills and financial savings and investments. It prevents you to go over funds in your spending.

- Prioritize bills – As this budgeting requires you to spend 50% in your wants, you are likely to plan out your bills.

- Helps meet long run targets – By saving 20% of your submit tax revenue, you may create a corpus to fulfill your long run targets, submit retirement bills and so forth.

How you can undertake 50/30/20 rule?

Listed below are some ways in which may enable you comply with 50/30/20 rule.

- Maintain a report and analyse your bills for a month or two. It will enable you perceive and classify your expanses beneath the three classes and set the groundwork for the adoption of the rule.

- Consider your after-tax revenue and attempt to allocate the proper funds quantities for the three classes.

- Determine your wants and desires.

- Allocate funds and determine the devices in your financial savings and investments.

- Preserve consistency by following this rule each month.

Conclusion

Whereas there isn’t a one option to handle your cash however 50/30/20 rule helps inculcate a wholesome behavior to handle cash effectively. It ensures that you just spend your cash diligently and have a larger management over the inflows and outflows of cash. It helps you direct funds for emergency bills and retirement.

Regularly Requested Questions

1. Can I modify the chances in 50/30/20 rule?

Sure, chances are you’ll modify the chances relying upon your circumstances and priorities.

2. Ought to I embrace taxes within the calculation of quantities beneath three classes?

Ideally, you shouldn’t think about taxes for the calculation.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0;t.defer=true; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js');

setTimeout(function() { fbq('init', '2933234310278949'); fbq('init', '3053235174934311'); fbq('track', 'PageView'); }, 5000);