I don’t assume it could be a lot of a stretch to imagine no one likes excessive mortgage charges.

They make it harder for potential residence patrons to get to the end line, particularly with lofty asking costs.

And so they’ve led to numerous mortgage layoffs and job losses in plenty of associated industries.

Positive, buyers would possibly earn extra curiosity on loans with increased mortgage charges, however provided that the loans are held onto to.

There’s a very good likelihood they’ll be paid off sooner somewhat than later, making them rather less engaging. However there may be one silver lining to those stubbornly excessive mortgage charges.

There Will Be a Mortgage Refinance Increase within the Close to Future

The longer mortgage charges stay elevated, the bigger the variety of high-rate residence loans in existence.

It’s fairly easy. If lenders maintain doling out new loans, they’ll undoubtedly have excessive rates of interest.

Should you take a look at the chart above from Black Knight, the typical rate of interest on excellent mortgages is round 3.94%, however is inching increased as time goes on.

As extra high-rate mortgages are originated, this common price will climb, thereby replenishing the very dry refinance pool.

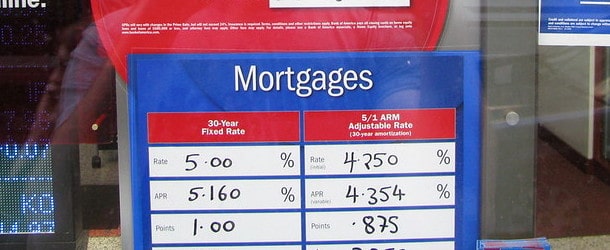

Finally look, the favored 30-year fastened mortgage goes for over 7%, up from the 2-3% vary in 2021 and early 2022.

Mortgage charges at the moment are near their twenty first century highs, with the 30-year fastened reaching 8.64% in Could 2000.

Hopefully we don’t go that prime, however something is feasible as of late.

Even 7% mortgage charges have prompted residence mortgage quantity to drop significantly, with mortgage refinances mainly nonexistent and residential purchases additionally dropping off resulting from sheer unaffordability.

We’ve by no means seen mortgage charges double in such a brief span of time, and it’s clear that is taking a large toll on the trade.

It’s hurting mortgage officers, mortgage brokers, actual property brokers, title and escrow officers, and plenty of others.

However regardless of this greater than doubling in mortgage rates of interest, there may be nonetheless appreciable enterprise happening.

Mortgage Lenders Are Nonetheless Anticipated to Shut Practically $2 Trillion in House Loans This Yr

Whereas the growth years have come and gone, the Mortgage Bankers Affiliation nonetheless forecasts $1.7 trillion in 1-4 unit residential residence mortgage quantity for 2023.

That’s on prime of the $2.3 trillion or so in residence mortgage originations in 2022, for which the 30-year fastened was priced within the 6s and 7s for an honest chunk of the yr.

After all, these numbers are down considerably from 2021, when mortgage lenders originated a document $4.4 trillion or so in residence loans.

Coming off a document yr to a doubling in mortgage charges is likely one of the causes it’s been so onerous for these in the actual property and mortgage trade.

As a result of enterprise was going gangbusters proper earlier than this unprecedented mortgage price spike, lenders had been absolutely staffed, as had been actual property brokerage homes, escrow and title firms, and so forth.

This sudden and violent shift meant staffing ranges had been going to want main changes. It wasn’t a gradual trickle down in enterprise, it was a fast decline.

Due to depressed gross sales quantity, many will depart the enterprise and never come again.

However as we’ve seen time after time, there will probably be alternative, particularly if there are fewer gamers left after the mud settles.

As soon as mortgage charges do come down, which they invariably will, trillions in residence loans will probably be ripe for a refinance as soon as once more.

It’s nonetheless not clear when this can occur, however it should occur, that a lot is true.

Householders Additionally Stand to Profit from Decrease Mortgage Charges within the Future

Whereas the trade goes via some powerful instances, current residence patrons are additionally struggling.

The 30-year fastened was a screaming discount a pair years in the past, and is now a thorn within the aspect of householders.

Because of provide shortages, residence costs have stayed close to document highs, regardless of a serious decline in affordability.

This has pushed the standard residence purchaser’s month-to-month cost as much as $2,605, per Redfin, up about 20% from a yr in the past. It’s now hovering round an all-time excessive.

In the meantime, months of provide remains to be lingering across the 3-month vary, nicely under the 4-5 months that symbolize wholesome ranges.

So at present’s residence purchaser nonetheless has to compete with many others, regardless of document excessive residence costs and equally costly mortgage charges.

Nonetheless, a time will come when mortgage charges come again down, permitting those that stick it via to see some reduction.

Currently, actual property brokers and mortgage officers have been pitching the so-called date the speed, marry the home line.

Merely put, the rate of interest is simply momentary however the residence might be yours perpetually. And if charges go down, you’ll be able to refinance your current mortgage and ideally pay loads much less for it.

This has but to transpire, which hammers residence the significance of having the ability to afford the housing cost in entrance of you, not some potential future one if the celebs align.

However as time goes on, rates of interest will come down. And people caught with charges within the 7s will be capable of snag one thing much more cheap.

So every day, as increasingly 7% mortgages are funded, extra alternative is being created.