Visa SavingsEdge Assessment

You probably have a Visa enterprise bank card in your pockets, then it is best to take a look at Visa SavingsEdge. It is a rewards program that could be very straightforward to make use of. You simply enroll your card after which get pleasure from financial savings at eligible retailers, each time you make a purchase order. You get an automated low cost that reveals up as a press release credit score.

It will get higher! These financial savings are along with the bank card rewards that you just already earn. So it can save you an additional 2% on fuel, 4% on choose lodge stays at Mandalay Bay, Wyndham and extra, and a couple of% at some chain restaurant equivalent to Panda Specific. Let’s see how this program works and how one can begin financial savings.

What’s Visa SavingsEdge

Visa SavingsEdge provides enrolled Visa Enterprise cardholders methods to save lots of on enterprise bills with On a regular basis Financial savings, which change into mechanically accessible after you enroll. There aren’t any coupons or codes. Financial savings are utilized mechanically as assertion credit on enrolled Visa Enterprise cardholders’ future account statements.

You’ll even have entry to On the spot Financial savings, which present in your cart prior to creating a purchase order while you enter a promotion code for the supply immediately on the service provider’s web site throughout checkout.

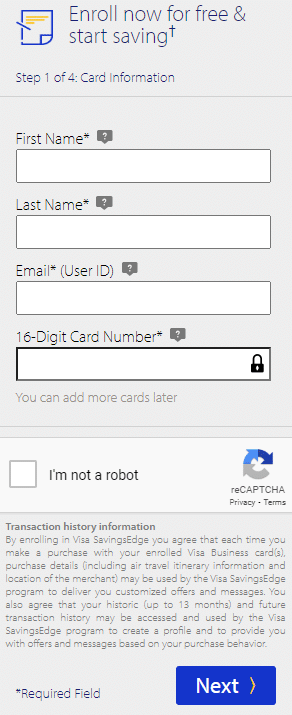

How one can Enroll

Merely enroll your legitimate Visa Enterprise card on the “Enroll” part of this system web site at www.visasavingsedge.com. Whenever you enter your Visa Enterprise card quantity throughout enrollment, Visa will confirm your card’s eligibility and ship affirmation of enrollment. Eligible playing cards embrace Visa Enterprise playing cards and a few Visa Industrial Pay as you go playing cards.

Your full card quantity is required to verify eligibility to take part in Visa SavingsEdge, to trace your qualifying purchases, and to allow Visa to concern your assertion credit.

You possibly can enroll as much as 10 eligible Visa Enterprise playing cards beneath a single login if you’re the enterprise proprietor or if you’re licensed by the enterprise proprietor to enroll a number of playing cards. Solely the cardholder who enrolled the playing cards will obtain electronic mail communications about this system and might entry the password-protected part of this system web site.

The way it Works

Saving with Visa SavingsEdge is straightforward. After enrolling your eligible Visa Enterprise card, you simply use it at eligible retailers. Right here’s an instance on the way it reveals in my Chase Ink Enterprise Money card’s statements:

5% again with Visa SavingsEdge

For On a regular basis Financial savings:

- Use your enrolled card at collaborating retailers with On a regular basis Financial savings.

- The financial savings quantity can be mechanically calculated primarily based on the service provider supply phrases.

- Financial savings will seem as assertion credit posted on a future Visa Enterprise Credit score and/or Verify Card assertion.

For On the spot Financial savings it really works extra like a purchasing portal:

- Register to Visa SavingsEdge and go to the On the spot Financial savings tab to view the present listing of On the spot Financial savings affords.

- Click on the “get low cost” button situated subsequent to a collaborating service provider listed within the On the spot Financial savings tab to proceed to the service provider’s web site.

- Make a qualifying buy on the service provider’s web site, following the redemption directions described within the supply particulars. Please confirm the low cost previous to finishing your buy. On the spot Financial savings promotion codes could also be topic to modifications or exclusions. There could also be further limits and restrictions related to a given On the spot Financial savings supply, together with restricted validity intervals and limitations on the variety of transactions eligible to obtain reductions.

Activate Gives:

- These are focused affords which can be just like Amex Provide and Chase affords. It is advisable to activate a suggestion and full the spending requirement as a way to obtain the credit score. These “Activate Gives” are fairly uncommon.

Eligible Retailers

Right here’s an inventory of all eligible retailers for On a regular basis Financial savings. The listing and financial savings charge would possibly change sometimes, so make certain to examine the web site earlier than making a purchase order.

Visa SavingsEdge Assessment: Guru’s Wrap-up

Visa SavingsEdge is a program that makes it straightforward to save lots of. You simply enroll your playing cards and also you mechanically save at eligible On a regular basis Financial savings retailers. It can save you on fuel, inns, eating, enterprise options and extra.

What makes it even higher is that the reductions are along with your bank card rewards. You probably have Visa enterprise playing cards in your pockets, and received by means of this entire Visa SavingsEdge evaluation, then you definately already know that there’s no motive to not enroll proper now. It’s free and straightforward.